We provide custody services to funds, investment managers, trusts, companies as well as individuals and family offices

Our high levels of service, diligence and commitment to going the extra mile for our clients reduces the burden on other advisers and gives comfort to fund investors and directors. You’ll have direct access to our highly experienced operations specialists by email and phone, as well as our secure online portal for your investment dashboard.

As we are based in the international financial centre of Guernsey we can work across fund domiciles. Wherever you or your clients are based in the world, our highly experienced team will deliver the level of personal service you deserve.

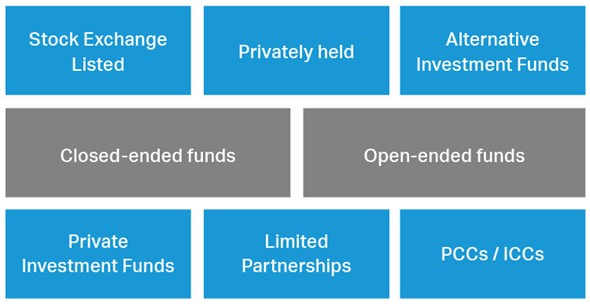

We work in partnership with depositaries and custodian trustees to provide custody services for open-ended and other collective investment structures where required.

More than just custody

Protection and guardianship of assets is of course central to our role as custodian. However our service offering extends to so much more, all delivered with care and diligence. Our comprehensive custody service includes:

- Trade settlement

- Income collection

- Corporate actions

- Proxy voting

- Reporting for tax reclamation purposes

- Multi-currency transactions

- Foreign exchange services

- Securities dealing

It is this care and careful oversight of your assets where we excel.

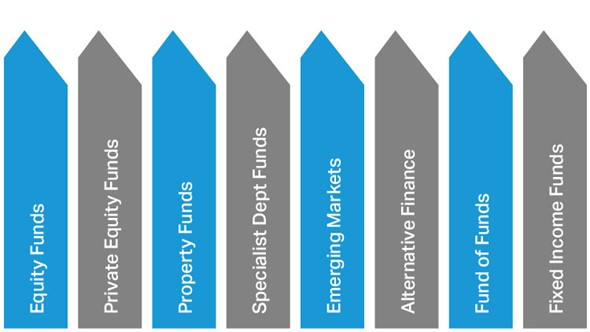

Flexibility across asset classes

We are a multi-asset custodian and work with different funds in different ways:

Private equity funds use us to hold stakes in companies they have partially exited through IPOs. They also use us for stake building in listed equity and debt targets and to make and hold strategic investments for underlying portfolio companies.

Property funds use us for investing in listed property stocks or fixed income investments which can complement illiquid physical property investments.

We also provide custody services to specialist debt funds, where we can hold CLOs, royalty notes and other complex investments.

Naturally, we also custodise more straightforward securities including global equities, fixed income and funds as well as private companies. In addition we can provide FX services, including forward currency contracts and dealing / trade execution services.

Fund clients include

Dealing, FX and execution

Our experienced dealing team is on hand to execute trades if required. Our high touch execution service combined with Liberum’s proprietary T-Rex trading algorithms, which delivers orders across multiple trading venues simultaneously, ensures you get institutional pricing no matter the stock or the size.

We can also provide FX services including implementing forward currency contracts.

We make the process of buying, holding and selling investments straightforward and cost-effective for you

Our focused offering of custody, trade execution and settlement enables us to give you and your advisers high levels of personal service while delivering value for money and institutional pricing.

We take a common sense approach to doing business and go the “extra mile” for our clients. We ensure that you are always in control by providing you with access to your accounts through our secure online platform and by offering a direct line to our professional and experienced operations and dealing teams.

Whether you invest in equities, fixed income, currencies, funds, derivatives or private investments, our experienced and expert team will ensure your instructions are executed diligently, efficiently and at institutional prices.